Table of Contents

ToggleIntroduction to Financial Calculators

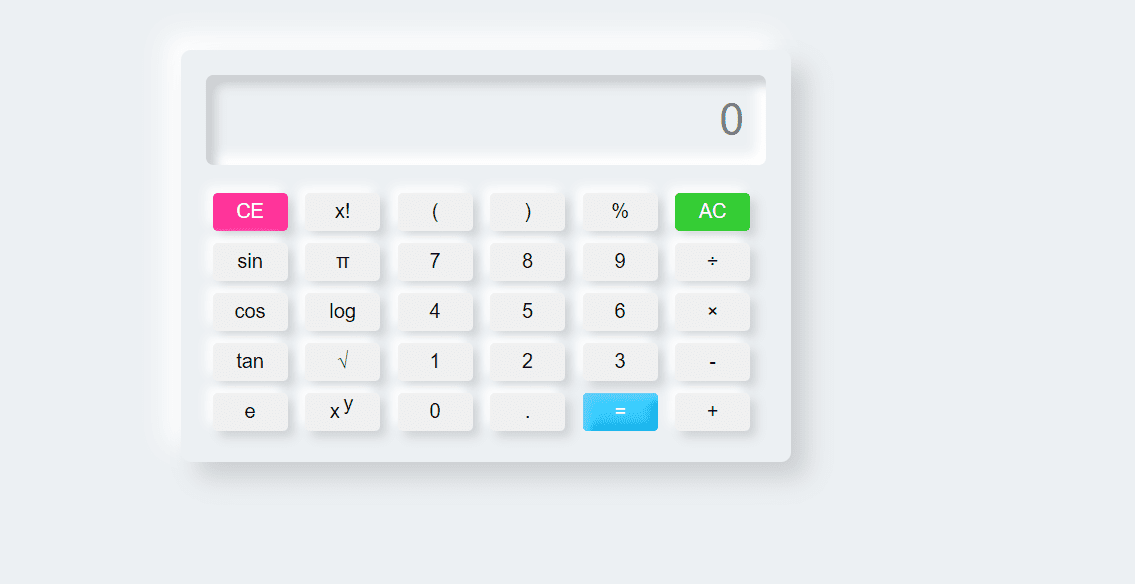

Financial calculators play a pivotal role in managing personal finances by providing individuals with the tools necessary to make informed decisions about their money. They have evolved significantly over time, offering increasingly sophisticated features to aid in financial planning. Here’s a breakdown of the different types of financial calculators and how they can be utilized effectively:

Types of Financial Calculators

Budget Calculators: These calculators assist in creating and managing budgets by helping individuals track expenses, set financial goals, and monitor their progress towards those goals. Online budget calculators simplify the budgeting process by automating calculations and providing visualizations of spending patterns.

Investment Calculators: Investment calculators are used to analyze potential returns and risks associated with investment opportunities. They help individuals understand their risk tolerance, evaluate diversification strategies, and forecast the growth of their investment portfolios over time.

Retirement Calculators: Retirement calculators estimate how much individuals need to save for retirement based on factors such as desired lifestyle, current savings, expected expenses, and retirement age. They also assess retirement readiness and allow for adjustments in contributions to ensure financial security during retirement.

Mortgage Calculators: These calculators are essential for individuals considering homeownership. They help calculate mortgage payments, determine affordability, compare different loan options, and analyze scenarios for refinancing or paying off mortgages early.

Loan Calculators: Loan calculators aid in analyzing various loan terms, including interest rates, repayment options, and payoff strategies. By inputting information such as loan amount and duration, individuals can visualize the impact of different repayment plans and save on interest costs.

Utilizing Financial Calculators for Effective Financial Planning

Budgeting: Online budget calculators streamline the process of creating and managing budgets by categorizing expenses, identifying spending patterns, and setting realistic financial goals. By regularly tracking expenses and adjusting budgets as needed, individuals can maintain financial discipline and work towards achieving their objectives.

Investing: Investment calculators assist individuals in making informed investment decisions by evaluating potential returns, assessing risk levels, and exploring diversification strategies. Understanding one’s risk tolerance and investment goals is crucial for selecting suitable investment options that align with long-term financial objectives.

Retirement Planning: Retirement calculators play a vital role in estimating retirement needs, assessing current savings, and determining the adequacy of retirement contributions. By inputting relevant financial information, individuals can gauge their readiness for retirement and make necessary adjustments to ensure financial security in later years.

Mortgage Management: Mortgage calculators help prospective homeowners calculate mortgage payments, assess affordability, and compare loan options. They also enable individuals to explore scenarios for paying off mortgages early or refinancing to potentially save on interest costs.

Loan Repayment Strategies: Loan calculators aid in analyzing different loan terms and repayment options to develop effective payoff strategies. By understanding the impact of interest rates and repayment schedules, individuals can optimize their loan repayment plans and save money over time.

Harnessing the Power of Compound Interest

Compound interest is a fundamental concept in finance that refers to the exponential growth of savings or investments over time. Compound interest calculators illustrate how small contributions or investments can accumulate significant wealth over the long term. By starting early and consistently contributing to savings or investment accounts, individuals can leverage the power of compound interest to achieve their financial goals.

Integrating Financial Calculators into Your Personal Finance Routine

Incorporating financial calculators into daily financial management practices is essential for maintaining financial health and achieving long-term objectives. Mobile apps and online tools make it convenient to perform calculations on the go and stay organized with budgeting, investing, and retirement planning activities. By regularly utilizing financial calculators, individuals can make proactive decisions to optimize their finances and secure their financial future.

Conclusion: Empowering Your Financial Journey

In conclusion, financial calculators are indispensable tools for managing personal finances effectively. By understanding the various types of calculators available and how to utilize them for budgeting, investing, retirement planning, mortgage management, and loan repayment strategies, individuals can make informed decisions to achieve their financial goals. Whether it’s estimating retirement needs, analyzing investment opportunities, or optimizing loan repayments, financial calculators empower individuals to take control of their financial future and build wealth over time.